How can we help you today?

Registered Office

Infowan Technologies Pvt Ltd

Mumbai-401107. INDIA.

Contact Details

+91 98201 97205

+91 98201 26871

+91 98670 74415

support@infowan.net

info@infowan.net

|

Table of Contents

|

|---|

| Pre-payroll Activities To Keep in Check |

| common pre-payroll activities |

| Data collection |

| Reviewing timesheets and Attendance records |

| Validate Employee Information |

| Payroll Reconciliation |

| Statutory Compliance Check |

| Producing payroll reports |

| Reviewing and approving payroll |

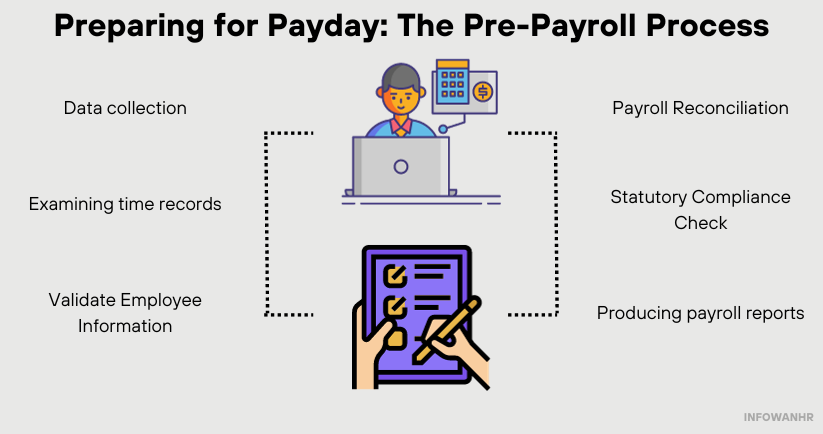

Pre-payroll activities refer to the tasks that must be completed before running the actual payroll process. These activities typically include verifying employee information, ensuring that employee data is accurate and up-to-date, reviewing time and attendance records, calculating leave balances, and determining any deductions or taxes that must be withheld. Other important pre-payroll activities may include creating payroll reports, reconciling payroll data with accounting records, and preparing payroll registers. Performing these tasks accurately and efficiently is crucial to ensuring that employees are paid on time and that payroll data is accurate for reporting and compliance purposes. Pre-payroll activities are essential tasks and processes that HR and payroll teams must complete before running the actual payroll. These activities help ensure accuracy, compliance, and efficiency in the payroll process.

Here's a detailed overview of common pre-payroll activities:

Data collection:Data collection in pre-payroll activities involves gathering and organizing information about employees. This includes personal details such as name, address, and contact information, as well as employment information such as job title, salary, and hours worked. Other important data includes tax withholdings, benefit enrollment, and any deductions or garnishments. The collection of this information is crucial to ensuring accurate and timely payroll processing. Employers may use various methods to collect this data, such as manual forms or electronic systems, and it is important to have proper procedures in place to protect the confidentiality and security of employee data.

Reviewing timesheets and Attendance recordsReviewing timesheets and attendance records is a crucial stage in pre-payroll activities. This process involves verifying employee work hours against scheduled hours to ensure accuracy. It also involves checking for any discrepancies or errors in time recording, such as missed punches or unauthorized absences. By reviewing timesheets and attendance records, employers can ensure that they are paying employees correctly and in accordance with labor laws, as well as identifying any potential issues before payroll processing. This stage can help to minimize errors and avoid costly payroll corrections later on.

Validate Employee Information:Validating employee information refers to the process of verifying that the data provided by an employee is accurate and up-to-date. This process is essential for ensuring that the information used by the organization is reliable and trustworthy. Validating employee information typically involves checking various details such as their name, address, contact details, employment status, and qualifications. The validation process may involve cross-checking the information provided by the employee with external sources such as government databases, employment history, and educational institutions. By validating employee information, organizations can ensure that they have accurate data to make informed decisions and comply with legal requirements.

Employee data that needs to be validated may also include:

1. Tax Withholding InformationThis process entails checking all payroll transactions for accuracy and completeness. Employee hours, salary, and benefit deductions are verified. Reconciliation also verifies tax withholdings, company contributions, and payroll expenses. Before processing payroll, reconcile all transactions to find and fix any inconsistencies. This ensures correct and timely employee payment and tax and other compliance. Payroll Reconciliation also ensures payroll data accuracy for financial reporting and analysis. Payroll Reconciliation is crucial to correct and timely payroll processing.

Statutory Compliance Check:Statutory compliance refers to legal requirements firms must follow when processing payroll. This includes the following tax, employee benefits, and other laws. Before processing payroll, HRMS software completes all legal formalities for statutory compliance. Calculate taxes, prepare payslips, and generate reports.

Producing payroll reports:This includes generating reports such as employee earnings statements, tax withholdings, and deductions. These reports can be used to track employee pay and ensure compliance with government regulations.

Reviewing and approving payroll:This is the final step of pre-payroll, where the payroll data is reviewed and approved by the management. This ensures that the payroll is accurate and compliant with all applicable laws and regulations.

By diligently addressing these pre-payroll activities, you can help minimize errors, ensure compliance, and ensure that employees are paid accurately and on time. This checklist can serve as a guide to help streamline your payroll process.