“Streamline Your Payroll – Find the Perfect Software Match” -InfowanHR

|

Table of Contents

|

|---|

| Payroll Software List – Top Solutions for Businesses in India |

| What is Payroll Software? |

| Benefits of Payroll Software |

| Key Features to Look For in Payroll Software |

| Payroll Software List – Best Options in India (2025) |

| How to Choose the Right Payroll Software from This List |

| Conclusion |

| Frequently Asked Questions (FAQs) |

Payroll Software List – Top Solutions for Businesses in India

Processing payroll has always been one of the most complex responsibilities for businesses in India.From calculating salaries to deducting taxes, managing benefits, and ensuring compliance with PF, ESI, and TDS, payroll is filled with repetitive and time-consuming tasks. Manual processes not only waste valuable time but also increase the risk of human error, which can result in penalties or unhappy employees.

That is where payroll software plays a transformative role. These solutions automate the entire payroll cycle, from attendance tracking to salary disbursement, while ensuring compliance with Indian labor laws. If you are searching for the most reliablebest payroll software in Indiathat can simplify employee payroll management system for your business in 2025, this article will give you the answers.

In this guide, we have compiled the payroll software list of the top solutions used by Indian businesses today. You will discover their features, strengths, and why they stand out. With InfowanHR ranked at the top of the payroll software list , followed by tools like Darwinbox, PeopleStrong, HONO, and more, you will be able to make a well-informed choice that matches your business requirements.

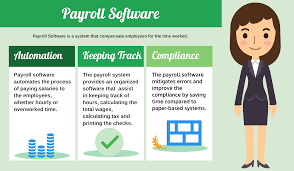

What is Payroll Software?

Payroll software is a digital solution designed to automate and streamline the process of paying employees accurately and on time...

Benefits of Payroll Software

- Accuracy in Salary Processing: Payroll software reduces human errors by automating calculations of salaries, overtime, bonuses, and deductions.

- Compliance with Indian Laws: The HR and payroll software in India automatically handles statutory deductions like PF, ESI, and TDS, ensuring your business stays compliant with government regulations.

- Time and Cost Efficiency: Businesses save hours of manual work every month, enabling HR teams to focus on strategic initiatives rather than repetitive tasks.

- Employee Self-Service: Employees can log in to portals or mobile apps to view payslips, apply for leave, and track expenses without depending on HR for every detail.

- Scalability: From startups with 10 employees to enterprises with thousands, HR software for small business can be scaled to handle the growing workforce.

When you review the payroll software list, you’ll notice that the best tools are designed not only to handle payroll but also to integrate with HR software and compliance functions, creating a seamless experience for employers and employees.

Key Features to Look For in Payroll Software

Before choosing from the payroll software list , it’s important to evaluate the features that make payroll systems efficient:

-

Automated Payroll Processing

Quick and error-free disbursement of salaries each month. -

Statutory Compliance

Quick and error-free disbursement of salaries each month. -

Leave and Attendance Tracking

Quick and error-free disbursement of salaries each month. -

Employee Self-Service Portal

Quick and error-free disbursement of salaries each month. -

Integration with HRMS and ERP

Quick and error-free disbursement of salaries each month. -

Mobile Accessibility

Quick and error-free disbursement of salaries each month.

These features are critical benchmarks when assessing options from the payroll software list in India.

Payroll Software List – Best Options in India (2025)

The following payroll software list highlights the most trusted and widely used solutions by businesses in India. Each tool has unique strengths, making it suitable for specific business needs.

InfowanHR – Best Overall Payroll & HRMS Solution

InfowanHR takes the top spot on our payroll software list because it combines payroll management with a complete HRMS solution. With more than 15,000 clients and over 2.7 million users across four countries, it is one of the most trusted solutions for payroll and HR automation.

Key Features:

- One-click payroll processing for quick and accurate salary disbursement.

- GPS-based attendance tracking, ideal for mobile and field staff.

- Automated leave, claim, and expense management.

- Advanced modules for recruitment, onboarding, performance, and training.

- Mobile-first design allowing employees to access features on the go.

Why it’s #1 on the Payroll Software List:

InfowanHR is designed for scalability, catering to SMEs as well as large enterprises. It provides measurable results, with claims of delivering up to 10x ROI by automating HR and payroll operations. Its compliance-ready platform makes it a standout choice for Indian businesses.

Darwinbox – Enterprise-Grade Payroll & HRMS

Strengths: Recognized as one of the leading enterprise-grade payroll and HR platforms in Asia.

Key Features:

- AI-powered analytics, HR automation, and scalability for large organizations.

Why it’s included in the Payroll Software List:

Darwinbox is highly regarded for handling complex HR structures in enterprises.

PeopleStrong – Comprehensive HCM & Payroll

Strengths: Combines payroll with human capital management (HCM).

Key Features:

- Multi-country payroll support.

- AI-powered chatbots.

- Workforce analytics.

Why it’s included:

A strong presence in India’s HR tech space and trusted by enterprises.

HONO HR & Payroll – Automation with Engagement

Strengths: Blends payroll automation with employee engagement features.

Key Features:

- Global payroll management.

- Compliance automation.

- Employee self-service.

Why it’s included:

HONO is user-friendly and effective for both SMEs and enterprises.

GreytHR – Payroll for SMEs

Key Features:

- Cloud payroll.

- Leave and attendance management.

- Compliance automation.

Best For:

SMEs looking for affordable payroll software.

Why it’s included in the Payroll Software List:

Easy to use and widely adopted by small businesses.

Zoho Payroll – Part of the Zoho Ecosystem

Key Features:

- Compliance-ready payroll.

- Payslip generation.

- Integration with Zoho tools.

Best For:

Small businesses already using the Zoho ecosystem.

Why it’s included:

Simplifies payroll for SMEs with limited HR resources.

Keka HR – Modern HRMS with Payroll

Key Features:

- Payroll.

- Attendance tracking.

- Performance management.

Best For:

Mid-sized businesses focusing on employee-friendly HR solutions.

Why it’s included in the Payroll Software List:

Combines payroll with a modern HRMS experience.

RazorpayX Payroll – Finance-Integrated Payroll

Key Features:

- Automated salary transfers.

- Direct bank integration.

- Compliance support.

Best For:

Startups and tech-driven businesses.

Why it’s included:

Simplifies salary payments with strong financial integrations.

Zimyo – Payroll & Engagement

Key Features:

- Payroll.

- Benefits management.

- Employee engagement modules.

Best For:

Fast-growing organizations looking for modern HR solutions.

Why it’s included:

Offers payroll plus employee engagement features in a single platform.

FactoHR – Flexible HR & Payroll Suite

Key Features:

- Payroll.

- Compliance automation.

- Employee self-service.

- Performance tools.

Best For:

SMEs and enterprises seeking flexible modular HRMS solutions.

Why it’s included in the Payroll Software List:

Known for its versatility and scalable offerings.

How to Choose the Right Payroll Software from This List

With so many options in the payroll software list, businesses must carefully evaluate which solution fits their requirements.. Here are some guidelines:

- Assess Your Business Size and Needs: Startups may need simple and affordable solutions like GreytHR, while large enterprises benefit from platforms like Darwinbox.

- Compare Pricing Models: Some vendors charge per employee per month, while others offer tiered subscriptions. Choose what aligns with your budget.

- Check Ease of Use: A user-friendly interface ensures faster adoption and fewer training challenges.

- Evaluate Support and Training: Strong customer support is essential for smooth payroll operations.

- Prioritize Compliance: Ensure the software automates compliance with PF, ESI, and TDS to avoid penalties.

Selecting the right tool from the payroll software list ensures your payroll processes are seamless, compliant, and future-ready.

Conclusion

Payroll is the backbone of employee satisfaction and compliance. Errors in payroll not only cause frustration but also expose businesses to fines and reputational risks. This is why investing in the right payroll management software is no longer optional.

The payroll software list shared above includes the most trusted solutions available in India in 2025. While InfowanHR stands out as the most comprehensive option combining payroll with HRMS features, other tools like Darwinbox, PeopleStrong, and GreytHR are also highly effective depending on business needs.

By selecting the right solution, your business can save time, reduce errors, and ensure compliance, all while improving employee satisfaction.

Frequently Asked Questions (FAQs)

Q1. What is the best payroll software in India in 2025?

InfowanHR ranks as the top choice in our payroll software list due to its complete HRMS integration...

Q2. Which payroll software is most suitable for SMEs?

GreytHR and Zoho Payroll are ideal for small and medium-sized enterprises...

Q3. Which payroll software is preferred by large enterprises?

Darwinbox and PeopleStrong are widely used by large organizations due to their ability to handle complex HR and payroll structures.

Q4.How much does payroll software cost in India?

On average, payroll software in India costs between ₹40 to ₹300 per employee per month, depending on the features and vendor.

Q5.Does payroll software ensure compliance with PF, ESI, and TDS?

Yes. All major tools on the payroll software list are designed to automatically handle compliance requirements under Indian labor laws.

Q6. Can payroll software integrate with HRMS or ERP?

Yes, most solutions such as InfowanHR, Keka, and PeopleStrong provide integrations with HRMS and ERP systems for seamless operations.

Q7. Is cloud payroll software secure?

Yes, leading vendors use advanced encryption, secure servers, and access control features to ensure data safety.

Q8.Which payroll software provides mobile access for employees?

InfowanHR, Zimyo, and Keka offer mobile-friendly payroll access so employees can download payslips, apply for leave, and track expenses from anywhere.

Related Blogs

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | What is HRMS? | What is HR Management? | 7 Roles of HRM | What is Human Resources? | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | What are the Functions of HRM | Functions of HRM | Human Resource Accounting | Difference Between HRM and HRD | Best HRMS Software in India | Top HRMS Software in India | HRMS Companies in India | What is 3rd party payroll | Payroll Software list | What is payroll management in HR