What is Payroll? A Complete Beginner's Guide to Payroll Management in 2025

If you have ever asked yourself, what is payroll and why it's important for your business, this guide will provide all the answers. Simply put, payroll is the process of calculating, managing, and distributing payments to employees. But what is payroll really, beyond just handing out salaries? It is a critical function that involves accuracy, compliance, and trust. Every business, whether a small startup or a growing enterprise, needs a clear understanding of what is payroll to operate smoothly and legally.

This comprehensive guide will explain what do you mean by payroll, why it is crucial for your business, and provide clear steps on how to do payroll effectively in 2025's evolving digital landscape. By the end, you will understand why payroll management system is not just an administrative task, but a strategic function that impacts your company's success.

What is Payroll?

So, what is payroll? At its core, payroll refers to the entire process of compensating employees for their work. This includes calculating gross wages, applying deductions such as taxes and social security, and ultimately disbursing the net pay. When someone asks, what do you mean by payroll, it means more than just handing out paychecks; payroll is about managing employee compensation accurately while adhering to all legal requirements and ensuring employee satisfaction.

Payroll is an integral part of HR and business operations because it touches on several key components:

- Gross wages including salary, bonuses, commissions, and overtime payments

- Deductions such as income tax, provident fund, health insurance, and other statutory contributions

- Net pay which is the amount employees take home after deductions

- Ensuring legal compliance with government regulations, including tax filing and employee benefits

Understanding what is payroll system helps businesses avoid legal risks, build employee trust, and maintain transparent financial records.

Why Payroll Matters to Every Business

Payroll management plays a vital role in the success of any business, regardless of size. Here's why knowing what is payroll is important for every organization:

Legal Compliance

Payroll ensures your business meets all government requirements for tax laws, provident fund (PF), tax deducted at source (TDS), and other labor regulations. Failure to comply can result in heavy fines and legal trouble.

Employee Morale and Retention

Employees expect timely and accurate payment. Efficient payroll software builds trust and helps retain valuable talent. When employees feel confident in their compensation, overall morale and productivity increase.

Financial Transparency and Budgeting

Payroll data provides insights into labor costs and helps you plan your business budget. It allows for clear financial forecasting and audit readiness.

Business Reputation

Handling payroll professionally reflects well on your business brand and can attract better employees and clients.

Hence, understanding what is payroll and prioritizing it is essential for sustainable growth.

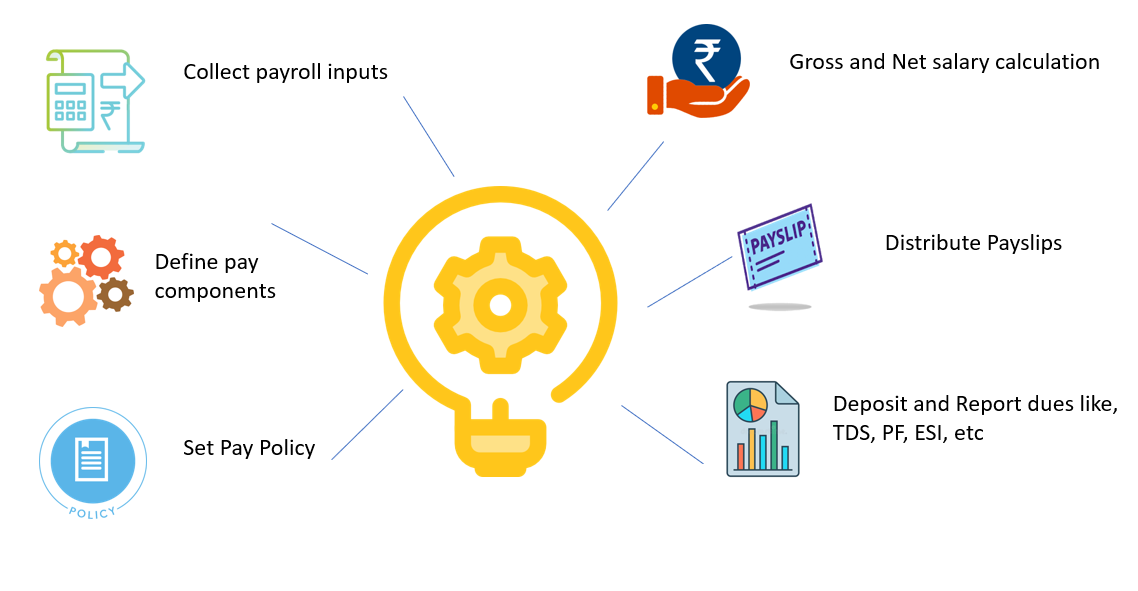

How to Do Payroll – Step-by-Step

Many new business owners often wonder how to do payroll without errors or delays. Here's a detailed step-by-step process that simplifies the task:

1. Collect Employee Information

Gather accurate data including bank account details, tax identification numbers (like PAN in India), attendance, and leave records.

2. Choose a Payroll Method

Decide whether to manage payroll manually, outsource it, or use payroll software. Each has pros and cons depending on your business size and budget.

3. Set Up a Payroll Schedule

Determine how often employees will be paid — monthly, biweekly, or weekly. Consistency is key for employee satisfaction.

4. Calculate Gross Pay and Deductions

Compute total earnings, including bonuses and overtime. Then subtract statutory deductions such as taxes, provident fund contributions, and other applicable withholdings.

5. Disburse Salaries and File Returns

Transfer net pay to employee bank accounts and submit all required tax and regulatory filings on time using an HR and payroll software India solution.

6. Generate Payslips and Reports

Provide payslips to employees and keep detailed reports for auditing and compliance.

By following these steps, anyone can learn how to do payroll properly and ensure both employees and the business are well taken care of.

Manual vs. Automated Payroll: Which is Better in 2025?

Understanding what is payroll includes knowing how to manage it effectively. Many businesses face the choice between manual payroll and automated payroll systems.

Manual Payroll Pros and Cons:

- Low upfront cost

- Full control over each calculation

- Time-consuming and prone to human error

- Difficult to scale with business growth

- Higher risk of compliance mistakes

Automated Payroll Benefits:

- Faster and more accurate calculations

- Easy scalability as your team grows

- Automatic updates for tax laws and compliance

- Employee self-service portals for payslips and tax forms

- Reduced risk of costly penalties

In 2025, automated payroll is the preferred choice for businesses that want to save time, reduce errors, and stay compliant. Understanding what is payroll also means embracing modern tools that simplify this essential business function.

Common Payroll Challenges & How to Overcome Them

Even with a clear understanding of what is payroll, many businesses encounter challenges:

- Mistakes in Tax Filing: These can cause penalties. The solution is to use payroll software that automatically calculates taxes.

- Incorrect Employee Classifications: Misclassifying employees can lead to compliance risks. Regularly audit classifications and update employee statuses.

- Lack of Record-Keeping: Manual record-keeping is error-prone. Transitioning to digital records improves accuracy and audit readiness.

- Keeping Up with Labor Laws: Labor laws frequently change. Use payroll systems with automatic compliance updates to stay current.

Being proactive in addressing these issues will improve your payroll process and reduce stress.

Features to Look For in Payroll Software

If you're considering how to improve payroll efficiency, look for software that offers:

One-click payroll processing

To save time

Integration with leave and attendance systems

For accuracy

Employee self-service portals

For transparency

Mobile accessibility

For managing payroll anywhere

Expense and travel reimbursement management

Compliance with local labor laws

And tax regulations

Choosing the right payroll software helps you automate complex tasks and focus on growing your business.

Why Cloud-Based Payroll Software is the Future

Cloud-based payroll solutions have transformed the way businesses manage what is payroll:

- They offer easy scalability as your business expands.

- Enable remote access, so payroll can be managed from any location.

- Provide real-time updates to keep data accurate and current.

- Reduce IT maintenance costs compared to traditional software.

- Enhance data security with regular backups and encryption.

These benefits make cloud payroll the future-proof choice for smart businesses in 2025.

Is Payroll Software Worth It for Small Businesses?

For many small businesses, investing in payroll software might seem expensive initially. However, understanding what is payroll helps reveal the true value:

- The cost of software is outweighed by the time saved on manual tasks.

- Automated payroll reduces the risk of errors and penalties which can be costly.

- It simplifies compliance, making audits easier and less stressful.

- Payroll software provides peace of mind, allowing you to focus on business growth rather than paperwork.

Overall, payroll software delivers a strong return on investment, especially as businesses grow.

Ready to Automate Your Payroll? Try InfowanHR

Managing payroll shouldn't take hours of your day. With InfowanHR, you can process payroll in a single click, manage attendance with GPS, and give your employees a self-service portal — all in one platform.

Trusted by over 15,000 clients and 2.7M+ users, InfowanHR is India's leading payroll & HRMS software tailored for businesses like yours.

Request a Free Demo Now and take the stress out of payroll!

Final Thoughts

Payroll is no longer just a backend administrative task. Knowing what is payroll means recognizing its strategic role in enhancing employee experience, ensuring legal compliance, and improving financial management. As businesses evolve, investing in the right payroll processes and tools early will enable smoother scaling and operational success.

Frequently Asked Questions (FAQs)

Q1. What is payroll in simple words?

Payroll is the process of paying employees by calculating their wages, deducting taxes, and distributing their salaries.

Q2. How do I get started with payroll?

Start by collecting employee information, choosing a payroll method, and setting up a payment schedule.

Q3. What do you mean by payroll deductions?

These are amounts subtracted from gross pay, including taxes, social security, and employee benefits.

Q4. Can small businesses manage payroll manually?

Yes, but manual payroll can be error-prone and time-consuming as your business grows.

Q5. How often should payroll be processed?

Typically, businesses pay employees monthly or biweekly, depending on company policy and legal requirements.

Q6. What are the benefits of using payroll software?

Software reduces errors, saves time, ensures compliance, and provides employee self-service options.

Q7. What documents do employees need to provide for payroll?

Usually, bank account details, tax identification numbers, and attendance records.

Q8. Is cloud-based payroll software secure?

Yes, cloud payroll providers use encryption, backups, and strict security protocols to protect data.

Related Blogs

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | What is HRMS? | What is HR Management? | 7 Roles of HRM | What is Human Resources? | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | What are the Functions of HRM | Functions of HRM | Human Resource Accounting | Difference Between HRM and HRD | Best HRMS Software in India | Top HRMS Software in India | HRMS Companies in India | What is 3rd party payroll | Payroll Software list | What is payroll management in HR