“Master Payroll with Confidence – Your Complete HR Guide” -InfowanHR

|

Table of Contents

|

|---|

| What is Payroll Management in HR? |

| Objectives of Payroll Management |

| Difference Between Payroll and HR Functions |

| The Role of Payroll Management in HR |

| Components of Payroll in HR |

| Payroll Process Explained |

| Common Payroll Challenges for HR Teams |

| The Future of Payroll Management in HR |

| Why Businesses Need Payroll Software |

| Best Practices for Effective Payroll Management |

| Conclusion |

| Frequently Asked Questions (FAQs) |

What is Payroll Management in HR? A Complete Guide for Businesses

If you are searching for a clear explanation of what is payroll management in HR, the answer is simple: it is the process of administering employee salaries, benefits, deductions, and statutory compliance in an organization. In other words, payroll management ensures employees are paid correctly and on time while the company follows government regulations.

This process is a critical part of human resource management because employee satisfaction and organizational efficiency depend on accurate payroll handling. Payroll also represents one of the largest expenses for any company, making it a function that directly influences financial planning, compliance, and workforce stability.

Over time, payroll has evolved from manual bookkeeping into advanced software-driven systems. In India especially, where labor laws and tax regulations frequently change, businesses are adopting cloud-based HRMS payroll software solutions like InfowanHR to simplify payroll management. These tools reduce manual work, eliminate compliance risks, and help HR departments focus on strategic growth rather than repetitive administrative tasks.

What is Payroll Management in HR?

To understand what is payroll management in HR, it helps to break it down into its meaning, objectives, and role within an organization. Payroll management refers to the systematic administration of financial records related to employees’ compensation, including salary processing, deductions, allowances, bonuses, and statutory contributions.

Objectives of Payroll Management

- Accuracy: Ensuring that every employee receives the correct salary amount, with deductions and allowances applied properly.

- Compliance: Meeting all tax and labor law obligations such as Provident Fund (PF), Employee State Insurance (ESI), and Tax Deducted at Source (TDS).

- Transparency: Providing employees with clear salary slips and accessible financial records.

- Employee Satisfaction: Ensuring payments are timely and reliable, which builds trust and improves morale.

- Organizational Efficiency: Streamlining payroll processes so HR teams spend less time on manual calculations.

Difference Between Payroll and HR Functions

- Payroll management focuses specifically on financial transactions related to salaries and compliance.

- HR management handles broader areas such as recruitment, employee development, engagement, and retention.

- Payroll is more transactional and repetitive, while HR is more strategic and people-oriented.

The Role of Payroll Management in HR

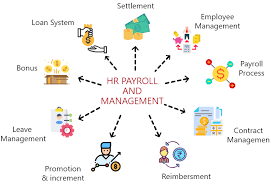

The role of payroll management within HR is multifaceted. When businesses think about what is payroll management in HR they must see it as both a financial and an administrative function. It ensures smooth workforce management through:

- Salary Processing and Deductions: Calculating gross pay, allowances, reimbursements, and applying statutory deductions.

- Statutory Compliance: Ensuring organizations remain compliant with labor laws in India such as PF, ESI, TDS, Minimum Wages Act, and Payment of Bonus Act.

- Employee Recordkeeping: Maintaining data about employee attendance, overtime, leaves, and salary history.

- Employee Satisfaction and Retention: When salaries are processed correctly and on time, employees develop higher trust in the organization and are less likely to seek employment elsewhere.

Payroll management, therefore, is not only about money; it is about organizational discipline and employee engagement.

Components of Payroll in HR

To understand what is payroll management in HR, it is important to know its components. Payroll has several elements that together ensure smooth salary processing:

- Employee Compensation: Basic salary and fixed components.

- Allowances and Benefits: HRA, travel allowance, medical benefits, and incentives.

- Deductions and Withholdings: PF, ESI, professional tax, and income tax deductions.

- Reimbursements: Payments made to employees for work-related expenses.

- Compliance Filings: Filing statutory returns, issuing Form 16, and submitting labor law documentation.

Each of these elements must be carefully managed, and errors in any one area can result in legal penalties or employee dissatisfaction.

Payroll Process Explained

The payroll process can be divided into three major stages:

The payroll process can be divided into three major stages:

-

Pre-Payroll Activities

- Defining company policies related to compensation, leave, and attendance.

- Collecting accurate employee data including attendance records, overtime hours, and expense claims.

- Validating all data to ensure there are no discrepancies.

-

Payroll Execution

- Calculating gross salary and applying deductions.

- Preparing salary registers for approval by finance or management.

- Generating payslips for employees.

-

Post-Payroll Activities

- Disbursing salaries through bank transfers.

- Filing statutory reports such as PF, ESI, and TDS.

- Preparing reports for management to analyze payroll expenses and workforce costs.

This cycle repeats every month, and efficiency depends on how well the organization manages each stage.

Common Payroll Challenges for HR Teams

Even when HR professionals know what is payroll management in HR, they face practical challenges in execution:

- Manual Errors: Calculations using spreadsheets often result in mistakes that affect employee trust.

- Complex Compliance: In India, tax laws and labor laws change frequently, making it difficult for HR teams to stay updated.

- Data Security Issues: Salary and tax data are sensitive, and mishandling can lead to confidentiality breaches.

- Employee grievances: Salary delays or incorrect deductions lead to dissatisfaction and attrition.

These challenges highlight why businesses must adopt technology-driven payroll management systems

The Future of Payroll Management in HR

The future of payroll lies in automation and technology. Companies exploring what is payroll management in HR today should prepare for the following trends:

- Payroll Automation: Reducing repetitive manual work through software. .

- Cloud-Based Payroll Software: Accessible from any device, with data stored securely online. .

- AI and Analytics: Predictive insights about workforce costs, employee performance, and salary trends.

- Integrated Systems: Payroll connected with attendance, leave management, and performance tracking to reduce duplication of data entry.

These trends will not only simplify payroll but also enhance the strategic role of HR in business growth.

Why Businesses Need Payroll Software

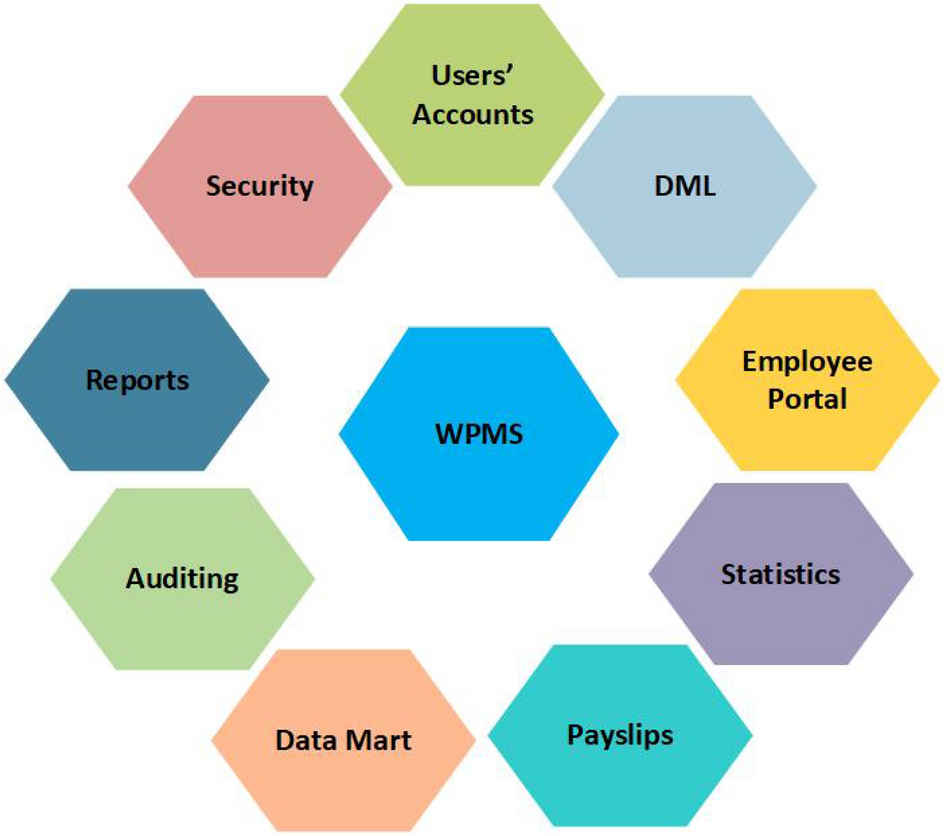

The need for payroll software is increasing among organizations that want accuracy, efficiency, and compliance. When businesses ask what is payroll management in HR,the modern answer is software-driven solutions. Payroll software helps by:

- Save Time and Costs: Automated payroll can process salaries in minutes instead of days.

- Assure Compliance: Software updates statutory rules automatically to keep the business compliant.

- Providing Employee Self-Service:Employees can access payslips, tax details, and reimbursement records through portals without depending on HR.

- Ensuring Scalability:Whether an organization has 20 employees or 2000, payroll software can adapt to its needs.

Cloud-based platforms such asInfowan HRMS payrollprovide businesses in India with the ability to handle payroll seamlessly while reducing operational risks.

Best Practices for Effective Payroll Management

To ensure efficient payroll, companies should follow best practices that align with modern HR standards:

- Standardize salary and leave policies.

- Automate payroll calculations.

- Conduct periodic audits.

- Implement cloud-based HRMS.

- Provide employees with self-service tools.

Looking to simplify payroll, attendance, and HR compliance? InfowanHR helps businesses process payroll in minutes, ensure 100% compliance, and give employees a seamless self-service experience. Request a Free Demo today!

Request a Free Demo at InfowanHRand transform your HR operations today.

Conclusion

In conclusion, what is payroll management in HR can be defined as the structured process of managing employee compensation, deductions, compliance, and reporting. Payroll is not just an administrative function but a strategic responsibility that impacts employee trust, organizational efficiency, and compliance with government laws.

Manual payroll methods are increasingly risky in today’s dynamic business environment. Cloud-based payroll management systems such as InfowanHR ensure accuracy, reduce errors, and save valuable time for HR teams. By embracing automation, organizations can achieve higher ROI and focus on long-term workforce development.

Frequently Asked Questions (FAQs)

Q1.What is payroll management in HR?

Administering employee salaries, deductions, benefits, and compliance.

Q2. Why is payroll management important?

Ensures satisfaction, compliance, and financial accuracy.

Q3. What are the key components of payroll?

Compensation, allowances, deductions, reimbursements, and filings.

Q4.How does payroll differ from HR?

Payroll is transactional; HR is strategic.

Q5.What challenges exist in India?

Frequent law changes, errors, security risks, salary delays.

Q6. What role does payroll software play?

Automates tasks, ensures compliance, provides self-service.

Q7. Can small businesses benefit?

Yes, software saves time and ensures compliance.

Q8.What is the future of payroll?

Cloud, automation, AI, and integration.

Related Blogs

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | What is HRMS? | What is HR Management? | 7 Roles of HRM | What is Human Resources? | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | What are the Functions of HRM | Functions of HRM | Human Resource Accounting | Difference Between HRM and HRD | Best HRMS Software in India | Top HRMS Software in India | HRMS Companies in India | What is 3rd party payroll | Payroll Software list | What is payroll management in HR