What is Payroll Management? A Complete Guide to Payroll Systems in India

If you've ever wondered what is payroll management, you're not alone. For any business—whether a startup, SME, or large enterprise—understanding what is payroll management is crucial to ensure employees are paid accurately and on time while staying compliant with government regulations.

This comprehensive guide will help you understand what is payroll management and why investing in an effective payroll system is essential for Indian businesses today.

What is Payroll Management?

Simply put, what is payroll management? Payroll management system refers to the entire process of handling employee compensation accurately and efficiently. This includes everything from calculating gross salary, applying statutory deductions like TDS, PF, and ESI, to distributing net pay and generating payslips.

Key components of what is payroll management include:

- Salary Calculation: Determining gross pay, allowances, bonuses, and deductions

- Statutory Compliance: Deducting and depositing mandatory contributions

- Payslip Generation: Issuing clear salary statements

- Salary Disbursement: Ensuring timely payments

- Record-Keeping & Reporting: Maintaining payroll records for audits

What is a Payroll System?

To grasp what is payroll management, you also need to understand what is payroll system. A payroll system is a software or tool that automates the payroll process.

Manual Payroll Systems

Using spreadsheets or paper records

Cloud-Based Payroll Systems

Online platforms with automatic updates

On-Premise Payroll Systems

Installed on company servers

Outsourced Payroll Services

Third-party providers handle payroll

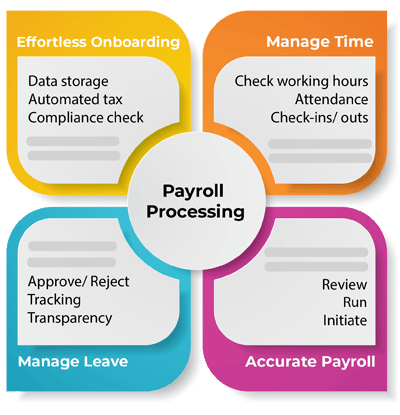

The Payroll Management Process Explained

Pre-Payroll Activities

- Employee Onboarding

- Defining Salary Structure

- Data Collection

- Validation

Actual Payroll Process

- Salary Calculation

- Statutory Deductions

- Verification

- Reconciliation

Post-Payroll Activities

- Salary Disbursement

- Payslip Generation

- Statutory Compliance

- Reporting

Common Challenges in Payroll Management

- Frequent Regulatory Changes: Keeping up with amendments in tax laws

- Human Errors: Manual calculations lead to mistakes

- Remote Teams: Managing multi-location payroll

- Lack of Integration: Disconnected systems

- Data Security: Protecting sensitive information

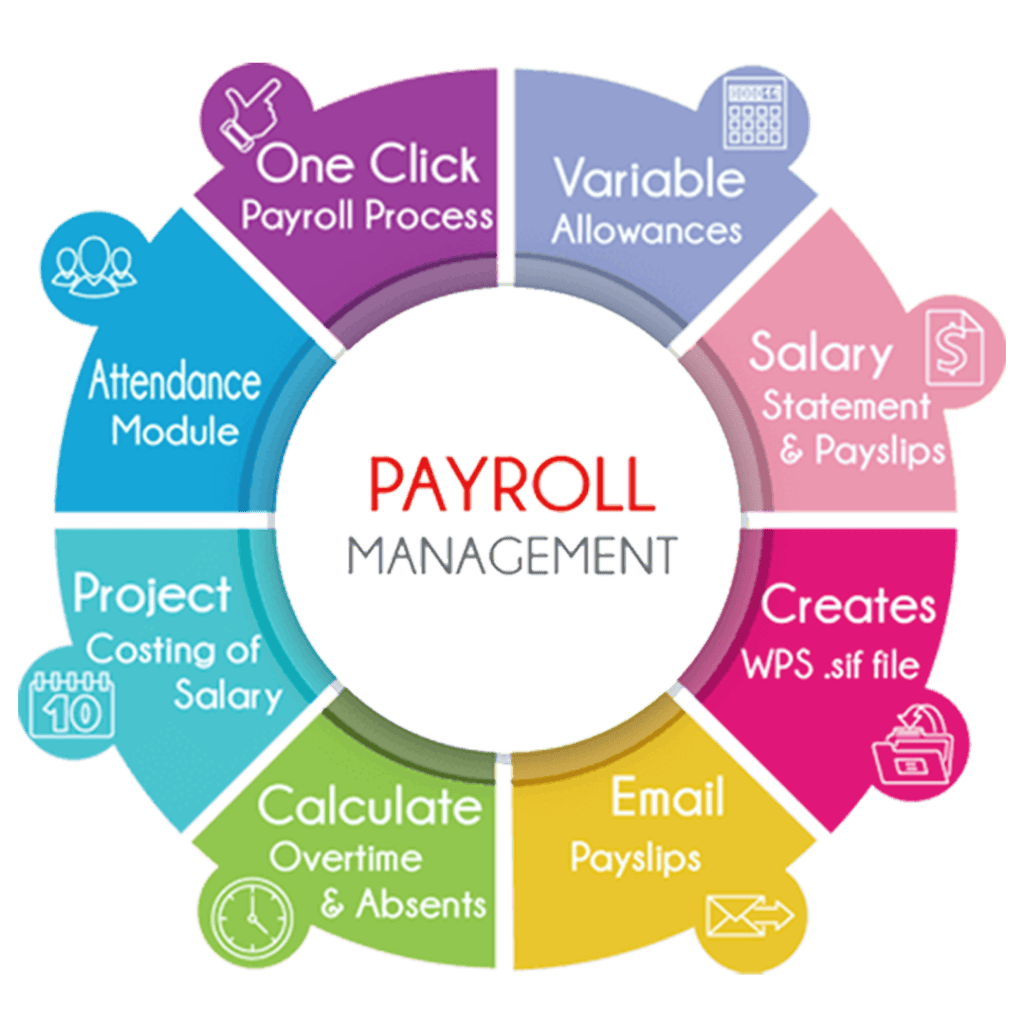

Features to Look for in a Payroll Management System

User-Friendly Setup

Easy onboarding and scalability

Automated Compliance

Updates for Indian laws

Employee Self-Service

Portals for payslips and claims

Attendance Integration

Seamless connection with attendance

Multi-location Support

Handling diverse payroll policies

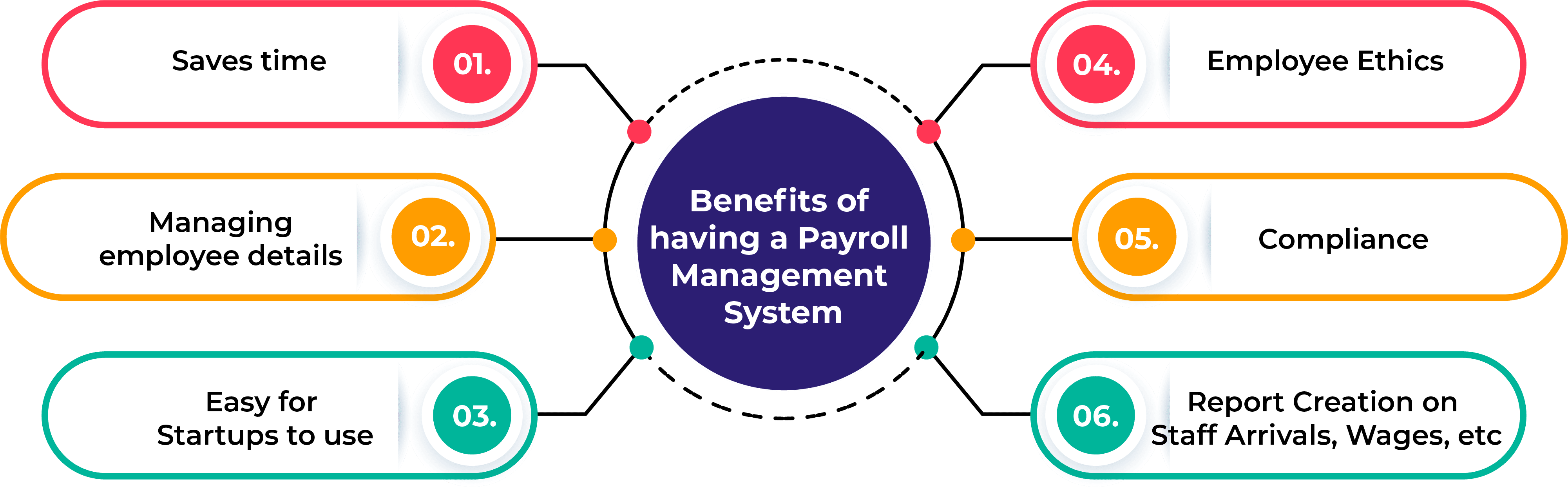

Top Benefits of Using a Payroll System

Time Saving

Automation reduces manual workload

Reduced Errors

Precise calculations minimize mistakes

Compliance Assurance

Stays updated with regulations

Improved Employee Experience

Timely payments boost morale

Payroll Management for Different Business Sizes

Startups and SMEs

Early investment in automated payroll prevents errors and compliance issues

Large Enterprises

Require integrated systems for multi-location HR operations

Why Choose InfowanHR for Payroll Management?

InfowanHR offers:

- Mobile App with GPS Attendance

- One-Click Payroll Processing

- Integrated Modules for Leave, Attendance, Travel

- Trusted by 12,750+ clients

Request a demo today to see how InfowanHR can revolutionize your payroll management

Conclusion

Understanding what is payroll management is critical for running a successful business. Leveraging a reliable payroll system automates this complex process, reduces errors, and saves valuable time.

Frequently Asked Questions (FAQs)

Q1. What is the meaning of payroll management?

The process of calculating employee salaries, deducting taxes, issuing payments, and ensuring compliance.

Q2. What are the benefits of payroll software?

Automates calculations, reduces errors, improves compliance, and saves time.

Q3. How does a payroll system work?

Collects data, calculates pay and deductions, generates payslips, and processes payments.

Q4. What software is best for Indian payroll compliance?

Cloud-based systems like InfowanHR that stay updated with Indian laws.

Q5. Can payroll systems handle multi-location businesses?

Yes, modern systems support different state-specific tax rules.

Q6. Is manual payroll management still viable?

Not recommended due to high error risk and inefficiency.

Q7. How often should payroll be processed?

Typically monthly, but can be bi-weekly or weekly.

Q8. Does payroll include employee benefits?

Yes, it manages bonuses, allowances, and statutory contributions.

Related Blogs

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | What is HRMS? | What is HR Management? | 7 Roles of HRM | What is Human Resources? | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | What are the Functions of HRM | Functions of HRM | Human Resource Accounting | Difference Between HRM and HRD | Best HRMS Software in India | Top HRMS Software in India | HRMS Companies in India | What is 3rd party payroll | Payroll Software list | What is payroll management in HR