How can we help you today?

Registered Office

Infowan Technologies Pvt Ltd

Mumbai-401107. INDIA.

Contact Details

+91 98201 97205

+91 98201 26871

+91 98670 74415

support@infowan.net

info@infowan.net

If you're asking what is payroll in HR, the answer lies in understanding its fundamental role in managing employee compensation within an organization. Payroll in HR refers to the systematic process of calculating, distributing, and recording salaries, bonuses, deductions, and statutory contributions for employees. It is an essential function that ensures every employee receives the correct pay on time while maintaining compliance with various laws.

Knowing what is payroll in HR means grasping how it impacts employee satisfaction, compliance, and organizational efficiency. Today's HR environment is complex, and payroll is no longer just about paying employees; it's a critical part of the entire employee lifecycle. This guide will comprehensively explain what is payroll in HR and what is payroll management in HR, highlighting their significance in modern organizations.

Understanding what is payroll in HR begins with recognizing payroll as a key administrative HR function that involves managing employee compensation. Payroll in HR encompasses the calculation of gross salaries, tax deductions, provident fund contributions, bonuses, allowances, and other benefits. It ensures that employees receive their rightful earnings accurately and punctually.

In most organizations, payroll is a collaborative effort among HR, Finance, and Compliance departments. For example, in India, payroll processing can vary between monthly and bi-weekly cycles, reflecting company policy and regulatory requirements.

By understanding what is payroll in HR, organizations can ensure accuracy, maintain legal compliance, and promote employee trust, which is vital for retaining talent. Learn more about HR and Payroll Software India to optimize this process.

Many professionals wonder what is payroll management in HR and how it differs from simple payroll processing. Payroll management in HR refers to the entire end-to-end system that oversees not only salary calculations but also integrates attendance, leave management, tax compliance, and reporting. You can explore comprehensive Payroll Management System solutions that support these functions.

Understanding what is payroll management in HR helps companies streamline operations, improve accuracy, and reduce legal risks. Check out Employee Payroll Management System for more insights.

Knowing what is payroll in HR makes it clear why payroll management is critical to organizational success. Effective payroll management ensures:

Accurate payroll processes guarantee adherence to tax laws and labor regulations, helping avoid costly fines.

When employees receive their correct pay on time, it builds confidence and reduces disputes.

Payroll data informs budgeting, cash flow management, and forecasting, enabling better business decisions.

Automating payroll reduces manual errors and the chance of costly mistakes.

Payroll management acts as a foundation for smooth HR operations and positively influences overall company culture.

Understanding what is payroll in HR also means recognizing the challenges that organizations often face in managing payroll:

Addressing these challenges is vital for maintaining accurate and compliant payroll operations. Discover how HRMS Payroll Software can simplify these processes.

For organizations that want to understand what is payroll in HR in today's technology-driven world, adopting a modern payroll system is essential. Such systems typically include:

Salary calculations and disbursements that eliminate manual errors

Integrated tax and compliance ensuring all statutory requirements are met

Seamless attendance and leave management integration

Portals allowing staff to access payslips and update information

For managing payroll on-the-go and supporting remote teams

Comprehensive reporting dashboards for insightful payroll data

These features not only simplify payroll processes but also enhance accuracy and transparency.

Knowing what is payroll in HR is key to appreciating how efficient payroll management can transform HR operations:

Automation reduces time spent on manual calculations and administrative tasks.

Self-service portals empower employees to access payroll data without HR intervention.

Cloud and mobile solutions facilitate payroll management across locations.

Real-time payroll analytics help HR leaders make strategic workforce decisions.

Payroll management turns HR teams from administrative processors into strategic partners within the organization.

Answering what is payroll in HR today includes understanding the growing importance of cloud-based HRMS (Human Resource Management Systems). Cloud platforms offer:

Easily support expanding workforces and business growth without heavy IT investments.

Payroll can be managed securely from anywhere, enabling hybrid work models.

Advanced encryption and compliance standards protect sensitive payroll data.

Immediate compliance with changing tax laws and labor regulations, reducing risk.

Cloud-based solutions are transforming how businesses approach payroll management in HR, making processes more agile and reliable.

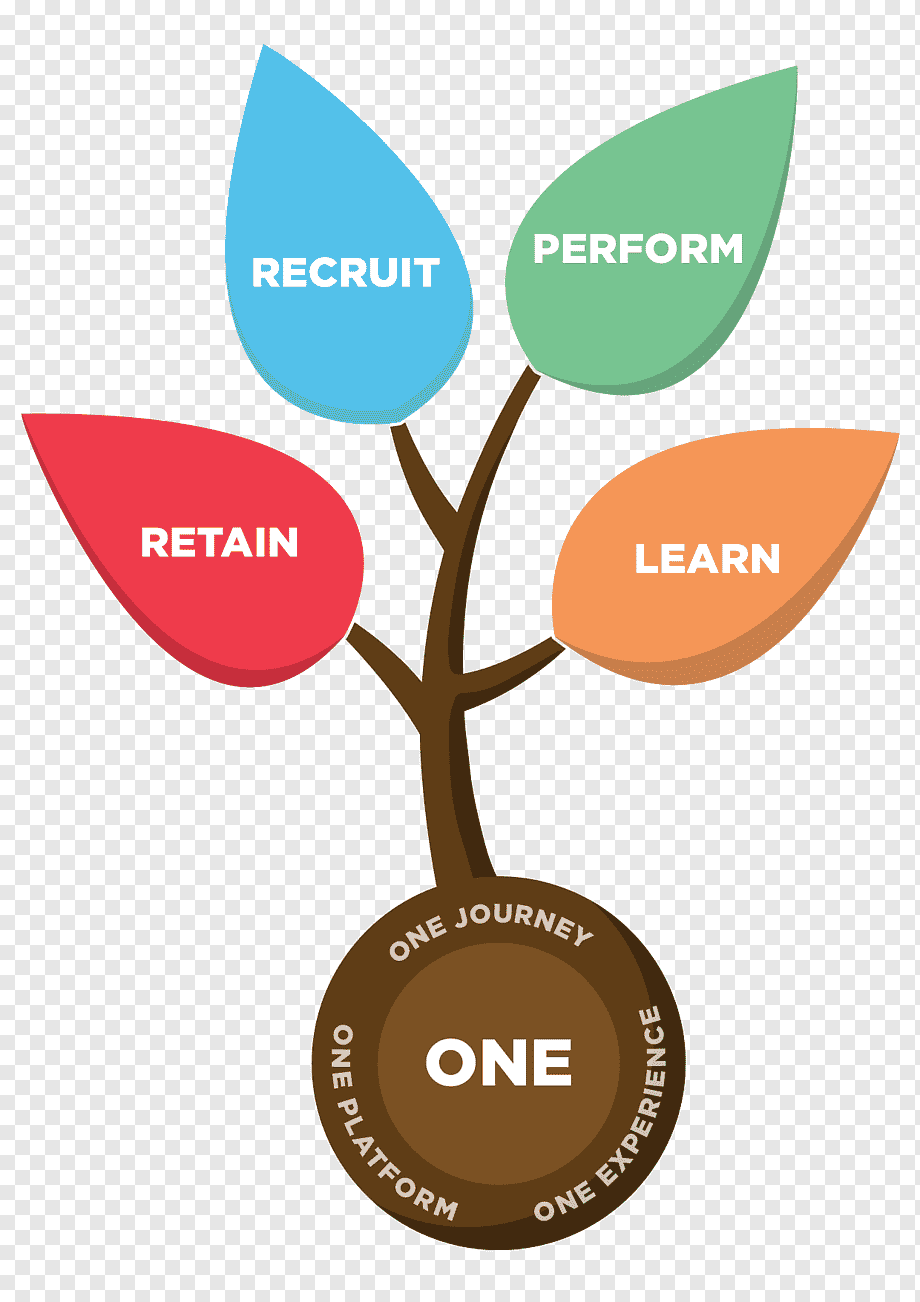

InfowanHR provides a cloud-based HRMS designed to answer the question what is payroll in HR by delivering an all-in-one platform for payroll and related HR functions. Key modules include payroll, attendance, leave, expense, and timesheet management.

InfowanHR is a powerful solution for businesses looking to modernize payroll management and HR operations.

Understanding what is payroll in HR is vital for any organization aiming for operational excellence, employee satisfaction, and regulatory compliance. Payroll management plays a crucial role not just in paying employees accurately but also in building trust, enabling financial planning, and supporting strategic HR functions.

Embracing digital payroll solutions like InfowanHR helps businesses automate complex processes, reduce errors, and stay ahead in today's competitive landscape. The future of payroll is digital, integrated, and employee-centric—making it essential for organizations to adopt modern payroll management practices now.

Request a Free Demo of InfowanHR today and experience seamless payroll processing!

Q1. What is payroll in HR?

Payroll in HR refers to the process of calculating and distributing employee salaries, deductions, benefits, and ensuring compliance with legal regulations.

Q2. What is payroll management in HR?

Payroll management in HR involves the entire process of managing payroll from attendance tracking and salary calculation to tax compliance and reporting.

Q3. Why is payroll important in HR?

Payroll is essential because it ensures employees are paid accurately and timely, maintains legal compliance, and builds employee trust.

Q4. How often is payroll processed in India?

Payroll in India is typically processed monthly but can also be bi-weekly depending on company policies.

Q5. What are common payroll management challenges?

Challenges include manual errors, regulatory compliance complexities, delays in approvals, and lack of real-time insights.

Q6. What features should a modern payroll system have?

A modern payroll system should offer automation, tax compliance, attendance integration, employee self-service, mobile access, and analytics.

Q7. How does payroll management improve HR efficiency?

It reduces manual workload, improves employee experience, supports remote teams, and provides data for strategic decisions.

Q8. Why choose a cloud-based HRMS for payroll?

Cloud-based HRMS offers scalability, remote accessibility, enhanced security, and automatic compliance updates, making payroll management more efficient.

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | What is HRMS? | What is HR Management? | 7 Roles of HRM | What is Human Resources? | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | What are the Functions of HRM | Functions of HRM | Human Resource Accounting | Difference Between HRM and HRD | Best HRMS Software in India | Top HRMS Software in India | HRMS Companies in India | What is 3rd party payroll | Payroll Software list | What is payroll management in HR