What is Payroll in HR? Everything Businesses Need to Know in 2025

The role of payroll in HR has expanded significantly over the years. With labor laws evolving and workforce structures becoming more dynamic, businesses must move beyond manual methods and embrace integrated HR payroll solutions. Whether you are a startup or an established company, streamlining your payroll process can save time, minimize legal risks, and improve employee trust.

This blog provides a complete breakdown of what is payroll system in HR, including its definition, process, components, common challenges, and how automation through tools like InfowanHR can transform your operations.

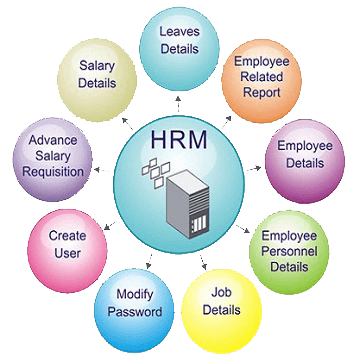

What is Payroll in HR?

To understand what is payroll in HR, think of it as the foundation of how organizations compensate their employees. Payroll in HR is the structured system used to calculate employee wages, manage statutory deductions, track benefits, and ensure timely salary disbursement while complying with government regulations.

This process includes tracking attendance, calculating overtime, managing leaves, and applying deductions like PF (Provident Fund), ESI (Employee State Insurance), and income tax. It also includes preparing payslips, filing tax returns, and generating reports required by government agencies and internal audits.

In some companies, payroll is managed solely by the HR team, while others may involve the finance department. Regardless of the approach, having clarity on what is payroll in HR is crucial for accurate and compliant operations.

Why Payroll is Crucial in Human Resources

Many business owners only realize the importance of payroll when something goes wrong. But understanding what is payroll in HR in depth can help you avoid costly mistakes. Payroll directly impacts employee satisfaction and organizational credibility.

Here’s why payroll is a critical HR function:

- It builds employee trust by ensuring accurate and timely salary payments.

- It ensures compliance with labor laws, tax regulations, and statutory norms.

- It provides financial clarity through well-maintained payroll records.

- It supports business continuity by reducing risk related to penalties and fines.

- It plays a key role in budgeting, workforce planning, and decision-making.

Without a proper understanding of what is payroll in HR, businesses may face unnecessary audits, legal trouble, and decreased employee morale.

Components of Payroll in HR

If you're still wondering what is payroll in HR, a key aspect is knowing its various components. Payroll is made up of multiple elements that contribute to how employee compensation is calculated and processed.

Here are the main components of payroll in HR:

- Basic Salary – The fixed amount paid to an employee excluding any benefits or bonuses.

- Allowances – Includes HRA (House Rent Allowance), travel allowance, medical allowance, and more.

- Deductions – Statutory and voluntary deductions such as PF, ESI, TDS (Tax Deducted at Source), professional tax.

- Gross Salary – Total earnings before deductions.

- Net Salary – The take-home salary after all deductions.

- Bonuses & Incentives – Performance-based pay or festival bonuses.

- Perquisites – Non-cash benefits like company car, accommodation, or meals.

- Statutory Compliance – Filing of returns and reports with government bodies for income tax, PF, ESI, and gratuity.

Understanding what is payroll in HR means mastering these elements and integrating them seamlessly into your monthly payroll cycle.

The Payroll Process: Step-by-Step

Once you know what is payroll in HR, the next step is understanding how the entire process unfolds each month. Payroll management isn’t a one-click affair—it follows a structured cycle that involves planning, processing, and compliance.

Here’s the typical payroll process broken down:

Pre-Payroll Activities:

- Set up and update employee records in the system

- Define payroll policies based on company norms and legal requirements using HRMS payroll software.

- Collect input data including attendance, leaves, expenses, and tax declarations in the employee management system.

- Validate all employee inputs for accuracy

Payroll Calculation Phase:

- Calculate gross salary based on working days, overtime, and leave balance using payroll management system.

- Apply deductions such as PF, ESI, professional tax, TDS, and loan EMIs

- Compute net salary for each employee

- Review payroll summary to eliminate errors

Post-Payroll Tasks:

- Disburse salaries through bank transfers or cheques

- Generate payslips and make them accessible via employee portals

- File statutory returns (PF, ESI, PT, TDS) with relevant authorities

- Maintain payroll registers and generate audit reports

Understanding what is payroll in HR helps businesses run these processes smoothly and consistently.

Manual Payroll vs. Automated Payroll Systems

If you’re still manually processing salaries in spreadsheets, you might be putting your business at risk. When evaluating what is payroll in HR, it's crucial to compare manual and automated methods.

Manual Payroll:

- Time-consuming and prone to human error

- Difficult to manage as employee count grows

- Increased risk of non-compliance

- No real-time insights or reports

- Limited data security

Automated Payroll Systems:

- One-click processing saves time

- Integrated with attendance, leaves, and tax modules

- Auto-calculates deductions and bonuses

- Real-time payslip generation and compliance tracking

- Offers high data security and access control

A modern business that understands what is payroll in HR will always lean toward automated systems to improve efficiency and accuracy.

Common Payroll Challenges Faced by HR

Even businesses that know what is payroll in HR face practical challenges, especially during scaling or compliance updates.

Common Payroll Issues:

- Keeping up with changing tax laws and government regulations

- Syncing real-time attendance, shift, and leave data

- Managing reimbursements, loans, and tax declarations accurately

- Handling payroll for remote or hybrid teams across locations

- Dealing with employee dissatisfaction due to salary or tax errors

- Preparing for audits without a central payroll repository

Addressing these issues requires robust HRMS tools and a solid understanding of what is payroll in HR.

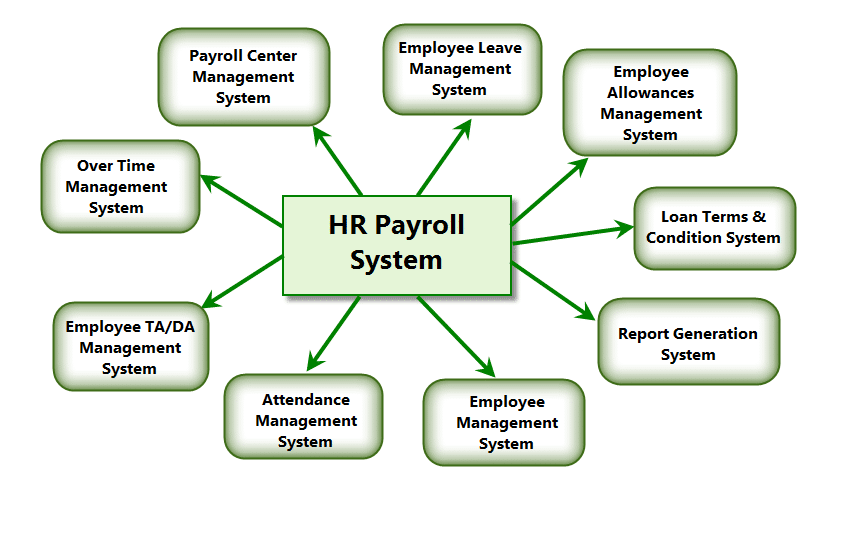

Key Features to Look for in a Payroll HRMS Solution

Once you’ve grasped what is payroll in HR, you’ll need a reliable HRMS solution that supports all facets of payroll management.

Key Payroll HRMS Features:

- Easy-to-use dashboard for quick payroll processing

- Integrated attendance and leave tracking

- Employee self-service portal for payslips, tax declarations, and updates

- Mobile access for remote management

- Automatic tax calculation and filing

- Secure cloud storage and access control

- Customizable salary structures and bonus calculations

- Real-time reports and compliance logs

A strong payroll HRMS ensures that knowing what is payroll in HR translates into actionable business outcomes.

Why Smart Businesses Choose InfowanHR

For businesses ready to move beyond theory and act on what is payroll in HR, InfowanHR offers a game-changing solution.

InfowanHR helps you:

- Save over 30 minutes per employee every day

- Reduce salary errors and boost employee satisfaction

- Automate payroll, tax filing, and compliance in one place

- Track attendance and leaves with GPS-based tools

- Offer employees mobile access and real-time payslip downloads

- Access a full HR suite including performance, travel, tasks, and more

With over 15,000 satisfied clients across 4+ countries, InfowanHR is a trusted HRMS partner for companies that understand what is payroll in HR is more than a function—it's a business enabler.

Conclusion

To conclude, understanding what is payroll in HR goes far beyond calculating monthly salaries. It's a strategic function that impacts every aspect of business—from financial compliance to employee morale. Businesses that manage payroll with manual tools or outdated systems are more vulnerable to legal risks, inefficiencies, and workforce dissatisfaction.

If your goal is to scale operations, reduce risk, and empower your HR team, investing in a modern payroll system like InfowanHR is a step in the right direction. It's time to streamline your payroll and future-proof your HR function.

Ready to modernize your HR operations? Streamline payroll, attendance, and compliance with InfowanHR, India's fastest-growing HRMS platform. Save time, reduce errors, and empower your workforce with mobile-first payroll and HR tools.

Book your Free Demo at Infowan.net or call +91 98201 97205.

Frequently Asked Questions (FAQs)

Payroll in HR refers to managing employee compensation, deductions, and compliance. It ensures accurate payments and legal adherence, which is vital for trust and business sustainability.

By using an HRMS tool like InfowanHR that automates attendance tracking, tax deductions, and salary processing, HR can manage payroll more efficiently.

A well-managed payroll system ensures timely payments, accurate tax deductions, and transparent communication—leading to higher employee morale.

Payroll is typically processed monthly, but some companies follow bi-weekly or weekly cycles depending on employment contracts and company policies.

While possible, manual payroll increases the risk of errors and non-compliance. Understanding what is payroll in HR helps even small businesses see the benefits of automation.

It's a shared responsibility. HR manages employee data and statutory inputs, while finance may handle disbursements and reconciliations.

Non-compliance can result in penalties, lawsuits, and employee dissatisfaction. That's why knowing what is payroll in HR and following best practices is essential.

Automated systems reduce errors, improve compliance, and save time—offering a better ROI and smoother HR operations.

Related Blogs

Best HR Software in India | Top HR Software in India | What is HR System | Online HR Management Software | Best Payroll Software India | Employee Payroll Management System | What is Payroll System | How to Use HRMS Software | What Are the 7 Roles of HRM | What is a Payroll Company | What is Business Management | What is Employee Engagement in HR | What is HR in a Company | What is HR Management | What is HRMS | What is HRMS System | What is HR Recruitment | What is Human Resources Management | What is Management Information System | What is Office Management | What is Payroll | What is Payroll in HR | What is Payroll Management | What is Payroll Processing