How can we help you today?

Registered Office

Infowan Technologies Pvt Ltd

Mumbai-401107. INDIA.

Contact Details

+91 98201 97205

+91 98201 26871

+91 98670 74415

support@infowan.net

info@infowan.net

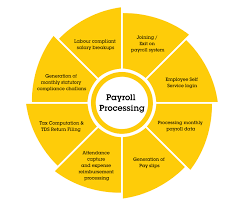

If you’ve ever wondered what is payroll processing and why it is essential for your business, you’ve come to the right place. What is payroll processing refers to the complete cycle of calculating employee wages, deducting necessary taxes, and making timely salary payments. This process is vital for businesses of all sizes, especially Indian SMEs and HR teams, to ensure that employees are paid accurately and on time.

Learning what is payroll processing also helps streamline HR operations, especially when integrated with HR and payroll software India solutions designed for compliance and ease.

Knowing what is payroll processing helps prevent costly errors, ensures legal compliance, and maintains employee satisfaction. In the fast-paced business world, mastering what is payroll processing can save companies valuable time and resources. This article will provide you with a detailed understanding of what is payroll processing, explain why it is crucial, and guide you through the step-by-step payroll process that every business should follow.

At its core, what is payroll processing is the method businesses use to manage employee compensation from start to finish. It involves gathering all necessary employee information, calculating the gross salary based on attendance or fixed pay, deducting taxes and other statutory contributions, and finally disbursing the net salary to employees.

Gross pay: The total earnings of an employee before any deductions, including basic salary, allowances, and bonuses.

Deductions: Statutory deductions such as Tax Deducted at Source (TDS), Provident Fund (PF), Employee State Insurance (ESI), and professional tax.

Net pay: The final amount paid to employees after all deductions have been applied.

By using an employee management system, organizations can automate the components of payroll while keeping employee data secure and accessible.

Understanding what is payroll processing thoroughly ensures your business adheres to labor laws, maintains proper records, and provides transparency in salary transactions.

Knowing what is payroll processing is not just about paying employees; it’s a crucial part of managing your workforce effectively. The importance of what is payroll processing can be summarized in the following points:

Many companies rely on HR software and HR software for small business to navigate payroll complexities efficiently.

For Indian SMEs, mastering what is payroll processing is especially important due to the complex and ever-changing tax and labor regulations.

To fully understand what is payroll process, it’s essential to break it down into clear, manageable steps. Here is a detailed look at the key steps involved:

Define your company’s pay cycle (monthly, bi-weekly), salary structure, and applicable tax rules. This foundation guides the entire payroll process.

Gather necessary employee details such as PAN card, bank account information, Form 16/11, and Aadhaar number for tax and salary processing.

Accurately monitor employee attendance, leave, and overtime using tools such as biometric devices or cloud-based attendance management systems.

Net salary is transferred to employees via integrated bank transfers.

Deduct taxes and contributions like TDS, Provident Fund, ESI, and professional tax as required by Indian labor laws.

Subtract all statutory deductions from the gross salary to arrive at the final take-home pay.

Pay the net salary through direct bank transfers or pay cards, and provide detailed payslips to employees for transparency.

File all necessary reports and returns such as EPF filings, professional tax submissions, and income tax returns with relevant government departments.

By following these steps, businesses can efficiently manage what is payroll processing while ensuring accuracy and compliance.

When dealing with what is payroll processing, even small mistakes can lead to significant problems. To help you avoid common pitfalls, here are frequent payroll errors to watch out for:

Manual miscalculations of salary or taxes that lead to errors.

Missing or ignoring statutory compliance deadlines.

Poor documentation of employee records and payroll transactions.

Incorrect classification of employees as contractors or permanent staff.

Avoiding these mistakes is essential for smooth payroll management and reducing risk.

Understanding what is payroll processing includes knowing the best tools for your business. Here’s how manual and automated payroll compare:

Time-consuming and prone to human error.

Difficult to keep up with changing tax laws and compliance.

Challenging to manage as the business scales.

Faster and highly accurate calculations.

Automatic updates for tax and labor law compliance.

Integrated with attendance and leave management systems.

Scalable for growing businesses.

Accessible on mobile and cloud platforms.

For most businesses, automated payroll solutions provide better control and efficiency in what is payroll processing.

When looking for payroll software to simplify what is payroll processing, consider the following:

Switching from Excel or manual methods to a robust HRMS solution like Infowan can revolutionize your payroll process.

Looking for an efficient way to simplify your payroll process? With Infowan HRMS, you can automate payroll, attendance, and compliance with just a few clicks. Trusted by over 8000 clients, Infowan helps you save time, reduce errors, and focus on growing your business.

Book a free demo today at https://infowan.net or call us at +91 98201 97205 to get started!

In conclusion, mastering what is payroll processing is essential for every business looking to run smooth HR operations. From calculating salaries to complying with tax laws, a well-managed payroll process protects your business and keeps employees happy. Leveraging automation tools like Infowan HRMS can transform how you approach what is payroll processing, saving you time and reducing errors.

If you want to focus more on growing your business while ensuring flawless payroll management, adopting an efficient payroll solution is the smart choice.

Q1. What is payroll processing?

Payroll processing is the entire procedure of calculating employee salaries, deducting taxes, and distributing payments while ensuring legal compliance.

Q2. What are statutory deductions in payroll processing?

Statutory deductions include mandatory amounts deducted such as TDS, Provident Fund, Employee State Insurance, and professional tax.

Q3. What documents are required for payroll processing?

Essential documents include PAN card, bank details, Aadhaar, Form 16/11, and employment contracts.

Q4. How often should payroll be processed?

Payroll is commonly processed monthly but can also be done bi-weekly or weekly depending on company policy.

Q5. What is the difference between gross salary and net salary?

Gross salary is the total earnings before deductions; net salary is the take-home pay after deducting taxes and contributions.

Q6. Can payroll processing be done manually?

Yes, but manual payroll processing is time-consuming, error-prone, and not scalable for larger organizations.

Q7. What are the benefits of automated payroll processing?

Automated payroll reduces errors, ensures compliance, saves time, and integrates with other HR systems for seamless management.

Q8. Why is understanding payroll processing important for businesses?

Understanding what is payroll processing helps businesses avoid legal penalties, keep employees satisfied, and manage finances effectively.

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | Payroll in HR | What is a Payroll Company? | What is Payroll Management? | Payroll Processing Explained | What is HRMS? | Understanding HRMS Systems | How to Use HRMS Software | Role of HR in a Company | What is HR Management? | Employee Engagement in HR | HR Recruitment Explained | What is Business Management? | Management Information System | Human Resources Management | 7 Roles of HRM | What is Office Management? | What is Human Resources? | Meaning of HR | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | What is Payroll Software? | Top 10 Payroll Software in India | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | Functions of HRM