How can we help you today?

Registered Office

Infowan Technologies Pvt Ltd

Mumbai-401107. INDIA.

Contact Details

+91 98201 97205

+91 98201 26871

+91 98670 74415

support@infowan.net

info@infowan.net

Managing payroll isn't just about calculating salaries — it's about ensuring employees are paid accurately, on time, and in compliance with local laws. Yet many businesses still rely on manual payroll processes or basic tools that increase the risk of costly mistakes.

So, what is payroll software, and why has it become a must-have solution for modern businesses?

Payroll software is a specialized tool designed to automate salary processing, tax deductions, compliance, and payslip generation. It replaces spreadsheets, paperwork, and repetitive manual calculations with a seamless, efficient, and error-free payroll process.

Whether you are an SME looking to simplify operations or an enterprise managing a large workforce across multiple regions, choosing the best payroll management software is critical to your success. In this guide, we'll cover what payroll software does, how it works, key features to look for, and why InfowanHR is one of the top choices for businesses today.

To put it simply, payroll software is a digital solution that automates and manages all payroll-related activities within an organization. This includes calculating employee salaries, managing statutory deductions, processing reimbursements, and generating payslips and tax forms.

Traditionally, payroll was managed manually using spreadsheets, calculators, and paper-based records. This not only consumed valuable time but also increased the risk of errors, especially when handling complex calculations like provident fund contributions, income tax, or overtime wages.

Modern payroll management software eliminates these risks by offering fully automated workflows, real-time calculations, and centralized data management. It ensures that payroll is processed accurately, legally, and efficiently — every single time.

In essence, if you're wondering what is payroll system , think of it as a central hub for salary, compliance, and employee compensation that supports both HR teams and business owners.

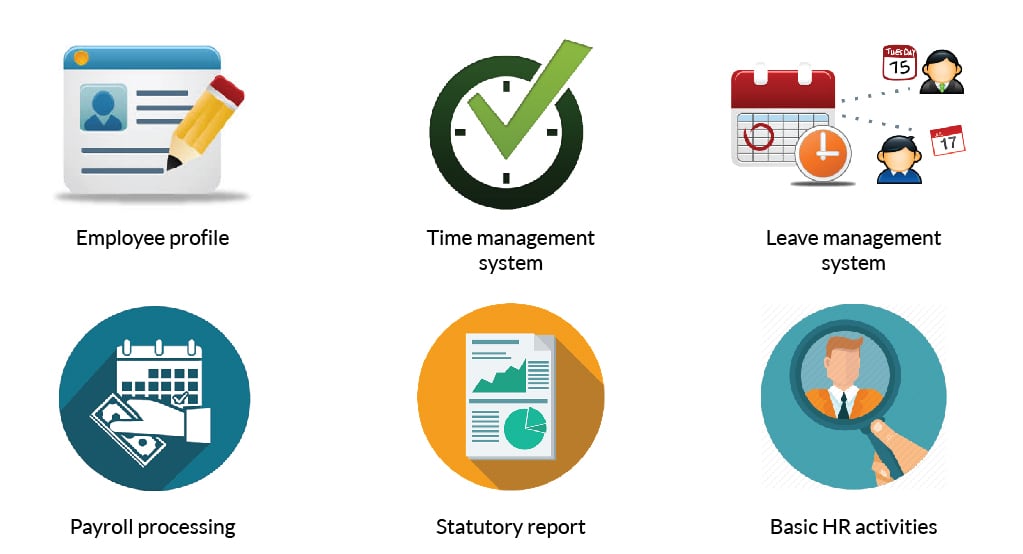

The way payroll system software works can vary based on the provider, but most platforms follow a core workflow that includes the following steps:

The software collects employee information such as attendance, leaves, shift details, and any variable pay components like bonuses or deductions.

Based on input data, the software automatically calculates gross pay, tax deductions, employer contributions (PF, ESI), and net payable salary.

A digital or printable payslip is generated and made available to employees through self-service portals.

The system helps file statutory returns, such as PF, ESI, TDS, and professional tax, in compliance with Indian regulations.

The software integrates with accounting systems, attendance tracking tools (GPS or biometric), and HRMS Payrolls to provide a seamless experience.

HR and finance managers can download detailed reports on salary expenses, compliance, tax liabilities, and more.

Most leading platforms offer cloud-based payroll software that enables access from anywhere, ideal for businesses with remote or hybrid teams.

When exploring what is payroll software, it's important to understand that it's not just a tool — it's a system that centralizes and simplifies the entire payroll process while ensuring compliance and data security.

If you're in the market for the best payroll software, here are the key features to look for. These capabilities help differentiate high-quality solutions from basic or outdated tools:

The best payroll management software should be intuitive, scalable, and equipped with tools to handle your business's current and future payroll needs.

Modern businesses need tools that save time, improve accuracy, and reduce costs — and this is exactly what payroll management software offers.

Here are the top benefits:

Reduces manual work by automating complex calculations

Eliminates human errors in tax and salary processing

Ensures accurate and timely salary disbursements

Improves compliance with government regulations and labor laws

Enhances employee trust with transparent payroll processes

Offers secure, centralized data storage and easy record access

Supports remote payroll operations with cloud-based access

Provides detailed reports and insights into salary and HR costs

Using an advanced payroll system software is a strategic move that goes beyond operational efficiency. It directly contributes to employee satisfaction, business compliance, and scalability.

Not all payroll software solutions are created equal. If you're trying to decide which is the best payroll software for your business, here's what to consider:

The software should be user-friendly and require minimal training.

Look for seamless integration with HRMS, accounting tools, and attendance systems.

Choose a platform that stays updated with Indian tax laws and handles statutory deductions.

Whether you're a 10-person company or managing thousands, the software should grow with your team.

Ensure the system uses secure cloud infrastructure and has encryption protocols.

Access to reliable support and onboarding assistance is essential.

Real-time insights and customizable reports can help improve payroll decision-making.

Ultimately, the best payroll management software aligns with your business goals while simplifying HR operations.

The payroll industry is evolving rapidly, driven by technology and the demands of hybrid workforces. Here are key trends to watch:

Becoming the norm, offering flexibility, real-time access, and cost savings.

Enabling HR tasks to be done from anywhere.

Helping businesses detect anomalies and forecast salary trends.

Ensuring accurate time tracking in remote or multi-site workforces.

Combining payroll with recruitment, onboarding, and training are gaining popularity.

Making payroll more personalized and region-compliant.

Via SaaS models is increasing as companies focus on core operations.

Benefits and reporting are also gaining traction in enterprise-grade solutions.

Understanding these trends helps you choose a future-ready payroll system software.

If you're looking for a reliable, scalable, and user-friendly solution, InfowanHR stands out as one of India's most trusted payroll software providers.

Here's why over 15,000 clients across 4+ countries trust InfowanHR:

When it comes to choosing the best payroll software, InfowanHR delivers both functionality and long-term value.

Now that you know what payroll software is, it's clear that it's much more than just a tool for salary processing. It's an essential system that brings accuracy, compliance, and operational efficiency to any business. The right payroll management software can significantly reduce your admin burden, enhance employee experience, and support your company's growth.

Try InfowanHR's Payroll Management Software — Request Your Free Demo Now!

Q1. What is payroll software used for?

Payroll software is used to automate the salary calculation, tax deductions, compliance filings, and payslip generation for employees in an organization.

Q2. How is payroll software different from HR software?

Payroll software focuses solely on salary and compliance, while HR software includes additional functions like recruitment, onboarding, performance, and training.

Q3. Which is the best payroll software in India?

InfowanHR is one of the best payroll software solutions in India, offering cloud-based, mobile-ready features and robust compliance tools.

Q4. Is payroll software suitable for small businesses?

Yes, even small businesses benefit from payroll software as it reduces errors, saves time, and ensures compliance with Indian labor laws.

Q5. Can payroll software handle tax and compliance automatically?

Modern payroll management software like InfowanHR automates tax deductions, PF/ESI calculations, and generates statutory returns.

Q6. What features should I look for in payroll system software?

Look for automation, compliance, integrations, self-service portals, mobile access, and real-time reporting features.

Q7. Is cloud-based payroll software secure?

Yes, reputable payroll providers offer enterprise-grade security including encryption, secure logins, and role-based access controls.

Q8. How can I get started with InfowanHR payroll software?

Visit www.infowan.net to request a demo or start a free trial with guidance from their payroll experts.

Best HR Software in India | Top HR Software in India | What is an HR System? | Online HR Management Software | Best Payroll Software in India | Employee Payroll Management System | What is a Payroll System? | What is Payroll? | What is HRMS? | What is HR Management? | 7 Roles of HRM | What is Human Resources? | Top HR Interview Questions | What is HR? | HR Analytics Explained | What is HR Compliance? | Human Resource Management Guide | Best HRMS System | HR Management System Software | HR Software for Small Business | Best HRMS Employee Self Service | What are the Functions of HRM | Functions of HRM | Human Resource Accounting | Difference Between HRM and HRD | Best HRMS Software in India | Top HRMS Software in India | HRMS Companies in India | What is 3rd party payroll | Payroll Software list | What is payroll management in HR